Cuba as a Place to Invest in

Following the passing of Law #118 “On foreign investment,” Cuba has begun to arrange a favorable business environment for foreign investors. In addition to tax benefits, it is offering an array of other advantages, including:

- Development of sectoral policy on a state level to identify investment opportunities for foreign capital, providing access to the Cuban market and its consumers;

- A straightforward process for creating a legal entity;

- Political, social, and legal stability, including a safe environment for foreign personnel;

- The country's geographical location in the middle of an expanding market.

- Favorable indicators in the education, social security, and health fields for the population;

- A highly qualified local workforce;

- State policy giving priority to technological research and innovations;

- State institutions with highly qualified personnel helping investors solve existing issues;

- Infrastructure all over the country: communication networks, over 20 airports, harbors allowing sea-faring vessels to dock, over 95% of the country's territories electrified, and well-developed railroad and automobile systems.

- International agreements have been concluded with the Latin American Integration Association (ALADI), the Caribbean Community (Caricom), the Bolivarian Alliance for the Peoples of Our America (ALBA), the Southern Common Market (MERCOSUR), the European Union (EU), and the World Trade Organization (WTO).

Cuba’s general policy on foreign investments (based on an analysis of materials published on the official website of the Cuban Ministry of Foreign Investments)

- Foreign investments are viewed as a source of economic growth for the country in the short, medium, and long term. Their attractiveness must be described in terms of goals: access to advanced technologies, development of management methods, diversification, expansion of export markets, import substitution, access to foreign financing, creation of new sources of occupations, and achievement of greater levels of income brought about by production relations with the national economy.

- Development of new management methods enhancing positioning on the market, boost productivity and profitability, the effectiveness of complex investment processes, and their development in all economic sectors.

- A preference for foreign investments designed for food supply import substitution.

- Facilitation of the development of comprehensive projects creating production chains in search of collective efficiency. These projects can be implemented with the same investor or with multiple investors sharing a common interest.

- In accordance with the country's demographic dynamic, foreign investments must provide access to advanced technologies raising efficiency and providing a means for workforce to be used efficiently.

- Facilitation of change in the country's energy matrix by way of using renewable energy resources using solar and wind energy as well as agro-industrial waste, such as sugar cane, forest biomass, and marabou, as well as electric biogas output.

- Consideration of the possibility for the involvement of foreign capital in addition to national science and technology development projects, preservation of intellectual property for obtained results, especially trademarks and patents created from Cuba.

- Consideration of foreign investment in certain types of economic industries as both an active and fundamental impetus of growth.

- Consideration of high-priority sectors: agricultural production and food industry; tourism, including health tourism; development of energy resources, especially renewable energy; scouting and development for hydrocarbons and mining resources; and construction or improvement of industrial infrastructure.

- Directing most foreign investments into export sectors, elimination of “bottlenecks” in the production chain, facilitation of modernization, changing the technological paradigm in the economy, and guaranteeing effective satisfaction of the country's needs for import substitution purposes.

- Assisting foreign investments in a broad, varied projects portfolio. Facilitating diversification of involvement of entrepreneurs from different countries. Devoting priority attention to the mass promotion of special development zones, including the Mariel ZED project.

- Consideration of priority fields of operations, related to the transfer of technologies and production chains implemented in poorly economically developed regions.

- Extracting minerals and providing public services where Cuban involvement will always be predominant.

- Introducing criteria into the requirements for the approval of business featuring foreign investments, which predict the impact on the payment balance over time as well as considering this element as a decisive indicator in whether or not the project is approved.

- The salary level's dependence on the completed work, efficiency, and added value generated by the company. Coordinating payment between the entrepreneur-employer and the company with foreign capital based on normative standards established by the Ministry of Labor and Social Security.

- Annulment of the concept of salary scale and establishment of a minimum salary, including payment of salary above the established minimum salary amount.

- Directing foreign investments toward developing forms of non-governmental property belonging to legal entities.

- A ban on transferring state assets for private ownership, except in cases when such shares are used for the purposes of developing the country and do not affect the nation's political, social, or economic foundations.

- Not providing economic rights to the Cuban market: foreign partner has equal rights to third parties and can be both a supplier and a client of the business.

- Guaranteed sales market in projects entailing goods and services export.

- Organization of tenders for design and construction between foreign and Cuban companies in accordance with the current investment process laws in the country.

- Creation of companies with fully foreign capital for implementing investments, especially for the development of industrial infrastructure by way of special “turnkey” contracts, such as: a Design, Acquisition, and Construction contract (IPC); a Design, Acquisition, and Construction Management contract (IPCM); Construction, Ownership, Operation, and Transfer Contract (BOOT), and Construction, Transfer, and Operation Contract (BTO).

- Refusal to accept foreign guarantees threatening the preservation of Cuban bank flows abroad.

- The international economic association’s assumption of a financial load on it tied to the enlargement of the investment budget.

- Implementation of direct and indirect foreign investments with long-term financing. Investments tied to the development of tourism will be treated as high-priority.

- The foreign investment climate Cuba creates must be able to guarantee its stability from the perspective of liquidity in foreign currency by way of attracting foreign financial flow as well as receiving income from exports and production chains in export operations. Those directed at effective import substitution in strategic economic sectors, such as food production and renewable energy resource development will be treated as exceptions.

- Facilitation of small business and investment volumes which are particularly geared for export in their nature or related to the production of export goods and services as well as facilitating the development of local producers.

- Inclusion of technologies facilitating the use of renewable energy resources into projects involving foreign capital.

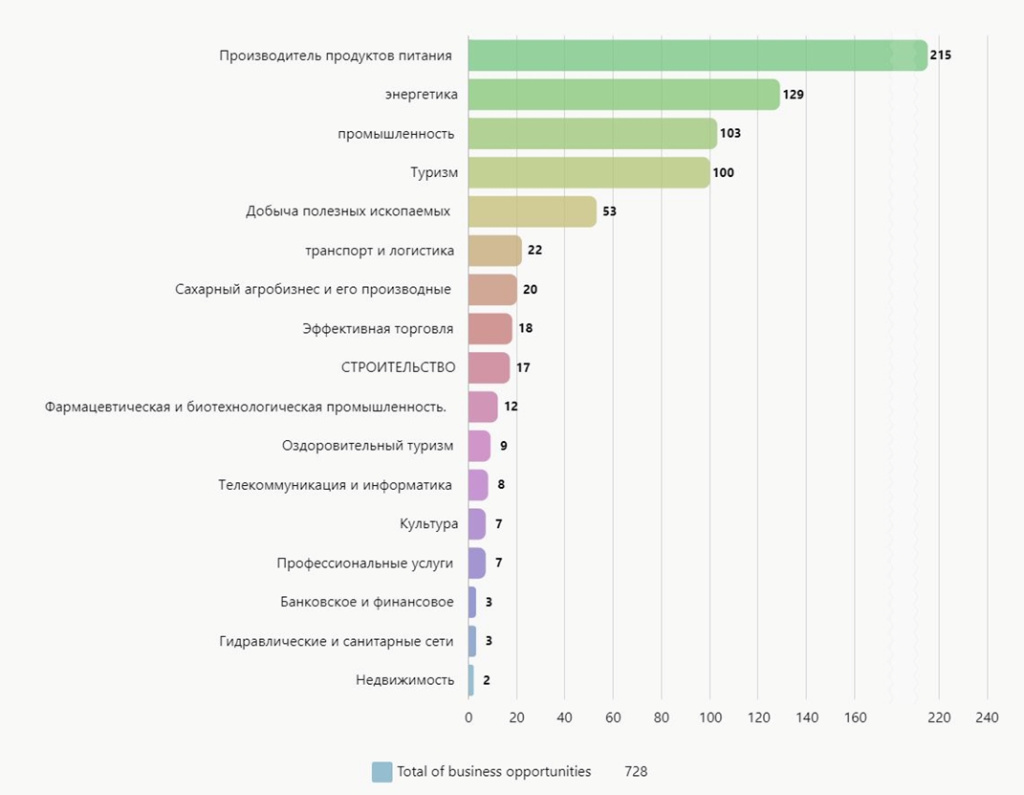

Investment opportunities in strategic sectors

Other articles on the topic

View articles

All modes of immigration to Italy

Everyone who thought about immigration to Italy for permanent residence tries first to find some information about any modes of such immigration.

...

Full layout of documents

With an aim to provide convenient, complete, and satisfying service to our customers, we provide “complete proofing” on top of our other regular services that we provide. This service entails processing a translation of the document the same way the original was. This service is primarily called for when translating printed publications, schemes, drafts, labels, and other graphic documents.

...

Services for the recovery and preparation of Russian documents for Spain

In close collaboration with the Spanish Embassy in Moscow, we specialize in providing as full a range of services as possible, pertaining to the claim and preparation of Russian documents for their subsequent use on the territory of Spain.

...